Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The Mission Investment Fund is a newcomer in the dynamic world of banking and investing. This innovative financial instrument goes beyond traditional investment strategies by emphasizing societal improvement while producing financial advantages. In this essay, we will look at the concept of a mission investment fund, its significance, and the potentially revolutionary role it could play in aligning financial goals with social and environmental

The Mission Investment Fund is a newcomer in the dynamic world of banking and investing. This innovative financial instrument goes beyond traditional investment strategies by emphasizing societal improvement while producing financial advantages. In this essay, we will look at the concept of a mission investment fund, its significance, and the potentially revolutionary role it could play in aligning financial goals with social and environmental

A mission investment fund is a special kind of investment that aims to provide favorable social or environmental results in addition to financial gains. Purpose investment funds, in contrast to traditional investment funds, are intended to distribute resources to projects and activities that are in line with a particular purpose or set of values. By using a mission-driven approach, investments are made to improve society and produce real results in areas like social justice, community development, and sustainability.

As the market for sustainable and socially conscious investing has grown, the idea of mission investment funds has changed over time. Instead of only pursuing financial benefits, investors are increasingly looking for ways to use their capital to impact society positively. Mission investment funds have come to serve as a link between the pursuit of profit and the aspiration to make the world more sustainable and egalitarian.

The dual goal of mission investment funds is to generate favorable social and environmental results in addition to competitive financial returns. This is one of their distinguishing characteristics. They differ from standard funds in that they have this dual focus, which gives investors a special chance to match their beliefs and financial objectives. Mission-investing funds allow investors to actively participate in initiatives that tackle important societal challenges and contribute to a movement that will ultimately result in good change.

Typically, mission investment funds work by locating and funding initiatives that support their stated objectives. These initiatives can be in any field, such as affordable housing, healthcare, education, and renewable energy. To make sure that each investment meets the fund’s financial goals, the fund managers thoroughly evaluate the possible financial returns on each one. Concurrently, a stringent screening procedure is employed to assess the social or environmental consequences of every project, guaranteeing congruence with the fund’s objectives.

Mission investment funds are crucial in the field of sustainable development because they help raise money for projects that create a more equitable and sustainable future. Whether they are used to finance social justice initiatives, small businesses in the neighborhood, or renewable energy projects, these funds are a major force for good. They provide investors with an avenue to actively participate in addressing global concerns like inequality and climate change through their investment decisions.

There are benefits beyond financial gains for investors who select mission-investing funds. Their investment journey is further enhanced by the psychological and emotional joy that comes from supporting a worthwhile cause. Furthermore, investing in mission-driven projects can increase a portfolio’s resilience and long-term profitability as the world comes to value and prioritizes sustainability. Investment funds with a mission focus give investors the chance to meet their financial objectives and leave a positive legacy.

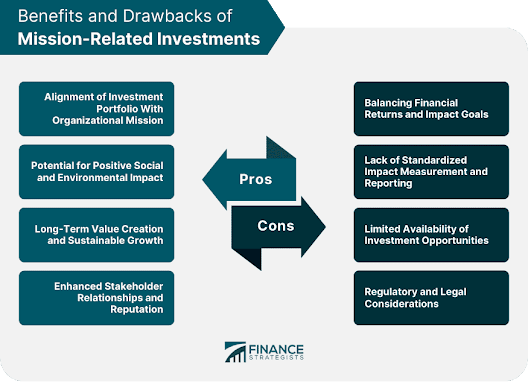

Although the idea of mission investment funds is commendable, it is important to recognize the difficulties and factors that come with them. Fund managers have to walk a tightrope when it comes to juggling social impact and financial rewards. Furthermore, clear measurements are necessary to assess the effectiveness of social impact projects, and investor confidence is largely dependent on reporting transparency.

With the globe still facing many difficult issues, mission investment funds will likely become more and more important. Investors are becoming increasingly aware of the potential effects that their financial choices may have on the environment and society. A more sustainable and socially conscious financial ecosystem will be made possible by the growing acceptance of mission-driven investment strategies in the changing financial landscape.

Yes, in addition to making money, mission investments usually seek to improve social and/or environmental conditions. They could be in favor of programs about community development, affordable housing, renewable energy, healthcare, and education.

America’s financial ministry is called the ELCA Mission Investment Fund. It provides ELCA ministries, congregations, and people with investment opportunities that are ethical and socially conscious, in line with the church’s purpose and core principles.

Fund managers for affordable housing that is connected to mission investments may have different ownership structures. They could be owned by government agencies, non-profits, private companies, or a mix of these.

The mission investment fund allocates funds to businesses or initiatives that share specific ideals or objectives, like a positive social or environmental impact. Aside from monetary gains, investors also want to feel good about themselves by making a constructive impact on society.

Benefits include supporting investments that have a positive social or environmental impact, matching financial returns with personal ideals, and even diversifying investment portfolios.

To sum up, a mission investment fund signifies a paradigm shift in the financial industry. These funds enable investors to be change agents by fusing financial goals with a dedication to positive social or environmental consequences. The need for ethical and ecological investing is growing, and mission investment funds are illuminating the path to a day when profit and purpose can live side by side. Accepting this novel approach to money can result in a world that is more fair, inclusive, and sustainable for future generations.

Prospects can be looked into by interested parties through affiliated funds, impact investing organizations, or financial advisors with a focus on socially conscious investing.

Prospects can be looked into by interested parties through affiliated funds, impact investing organizations, or financial advisors with a focus on socially conscious investing.

Mission investments aim to achieve both financial returns and societal or environmental consequences, while standard investments typically focus only on financial rewards.

Saqib Hussain, the mastermind behind the thought-provoking WORLD NEWS, is a prolific author renowned for his insightful exploration of news, artificial intelligence, finance, science, and technology. Graduating with a master’s degree in creative writing from Oxford University, saqib Hussain’s educational background shines through in his meticulously crafted prose.

Hussain’s unique blend of in-depth research and keen observation sets him apart in the literary world. His passion for books, technology, finance, and artificial intelligence infuses his writing with depth and clarity that captivates readers from all walks of life. Beyond his literary pursuits, Hussain finds inspiration in sports, entertainment, and the ever-evolving landscape of technology.

Through his writing, Hussain sheds light on crucial issues shaping our world today, offering a fresh perspective that challenges readers to think critically. With an unwavering commitment to excellence and a profound understanding of his craft, Saqib Hussain continues to shape the narrative of our time, leaving a lasting impact on those who delve into his compelling works.

[…] disadvantages to take into account. They might not treat you as personally as smaller legal companies because they are a larger company, which can make you feel like just another client. Additionally, […]

Очень трендовые новинки подиума.

Все мероприятия самых влиятельных подуимов.

Модные дома, лейблы, haute couture.

Приятное место для трендовых хайпбистов.

https://rftimes.ru/news/2024-07-05-teplye-istorii-brend-herno

[…] brokers act as an intermediary between traders and the global forex market. They connect traders to the vast network of banks, financial institutions, and other market […]